- Home

- =>>

- Government

- =>>

- Department Of Sales Tax Mumbai...

Department Of Sales Tax Mumbai Customer Care Help Desk Number : mahavat.gov.in

Company : Department Of Sales Tax

Head Quarters : Mumbai

Industry : Tax

Service / Product : Sales Tax Service

Website : https://mahagst.gov.in/en/log-e-services

| Want to comment on this post? Go to bottom of this page. |

|---|

MAHAVAT Sales Tax Customer Help Desk Number

C D A Help Desk :

** 022-23760827

** 022-23760831

** 022-23760710

Related / Similar Service :

Maharashtra Post Customer Service Number

** 022-23760076

** 022-23760833

** 022-23760828

** 022-23760138

Pune CDA help desk :

** 020-26609288

Nashik CDA Help desk :

** 024-12354486

** 025-32335886

Email us : mstdcdahelpdesk AT gmail.com

Border Check Post :022-23760387

Email Us :

** patil.sd AT mahavat.gov.in

** dhande.dd AT mahavat.gov.in

e-Registration

MAZGAON :

** 022 / 23760646

** 022 / 23760071

** 022 / 23760062

** 022 / 23760065

** 022 / 23760060

** 022 / 23760072

** 022 / 23760061

** 022 / 23760068

** 022 / 23760069

** 022 / 23760063

** 022 / 23760168 CRO

** 022 / 23760181 CRO

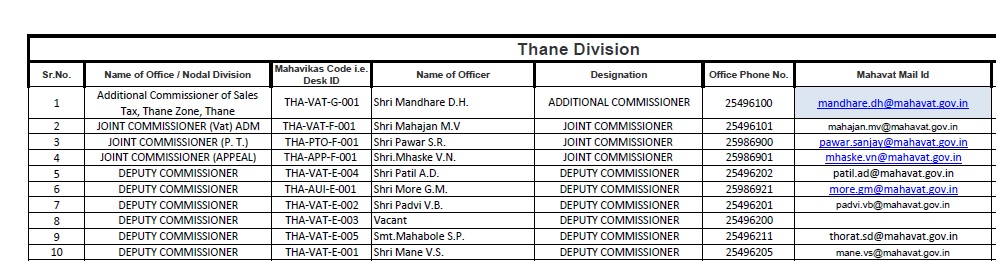

THANE :

** 022 / 25496268

KALYAN :

** 0251 / 2315945, 66

** Extn – 157, 101

NALASOPARA :

** 0250 / 2412066

PALGHAR :

** 02525 / 257484

RAIGAD :

** 022 / 27571539 – ext 3204, 3207

PUNE :

** 020 / 26609230

** 020 / 26609226

** 020 / 26609218

** 020 / 26609225

** 020 / 26609192

** 020 / 26609229

SOLAPUR :

** 0217 / 2603458

BARSHI :

** 02184 / 220134,35

** Extn 207

OSMANABAD :

** 02472 / 225021

** 02472 / 225022

** 02472 / 225023

** 02472 / 225024

KOLHAPUR :

** 0231 / 2666340

** Extn – 123

** 0231 / 2666341

** Extn – 123

** 0231 / 2663631

** Extn – 123

** 0231 / 2663632

** Extn – 123

** PA 0231 / 2352408

SANGLI :

** 0233 / 2622528

** Extn – 241

** 0233 / 2623719

** Extn – 241

** 0233 / 2623583

** SATARA

** 02162 / 234074

** Extn – 29

RATNAGIRI :

** 02352 / 222010

ORAS :

** 02362 / 228836

Email us : eregistrationhelp AT mahavat.gov.in

e-704 : 022/23760517

Email Us :

** activitycodes AT mahavat.gov.in

** e704help AT gmail.com

e-Payment

** 022/23760108

** 022/23760110

** 022/23760109

** 022/23760123

** 022/23760112

** 022/23760113

** 022/23760114

** 022/23760115

** 022/23760116

** 022/23760117

** 022/23760118

** 022/23760120

** 022/23760121

** 022/23760124

** 022/23760131

** 022/23760132

** 022/23760140

** 022/23760142

** 022/23760143

** 022/23760144

** 022/23760145

** 022/23760146

** 022/23760255

** 022/23760254

** 022/23760257

** 022/23760258

** 022/23760259

** 022/23760253

** 022/23760252

** 022/23760292

** 022/23760297

** 022/23760293

** 022/23760289

** 022/23760259

** 022/23760296

** 022/23760289

** 022/23760291

** 022/23760252

** 022/23760290

Email us : epayment AT mahavat.gov.in

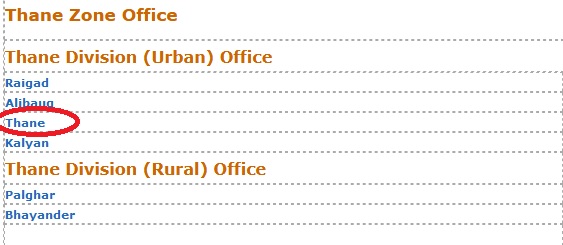

Zone Office Number

If you want to have Zone office number.

** Go to home Page click Contact Us button

** Then Zone Office Screen will be displayed .

** You Select One particular region and get your Result in PDF Format.

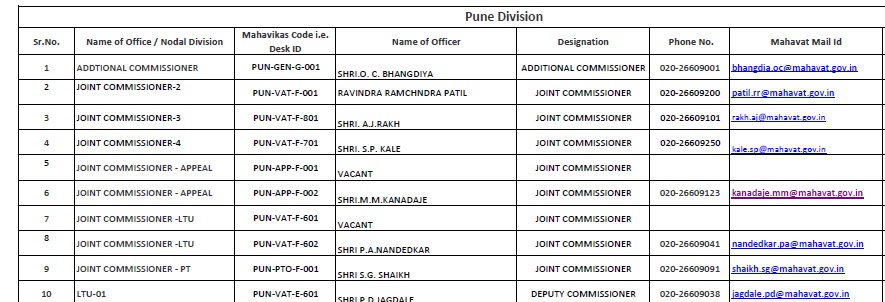

Pune Zone Office Number

Nagpur Zone Office Number

The result will be displayed as Follows

Thane Zone Office Number

The result will be displayed as follows

I create new registration I got activation mail but user id n password mail not received.so what I’do now

How to Download PTEC Paid Challan ?

Our Registration No. 27840350238P, We had already paid PTRC PAYMENT RS.8100/- ON DTD.31.03.2021 and BANK CIN Ref No. 020039420210331XXXXX not showing when we are submitting the return. what to do?

and HELP DESK NUMBER ARE NOT PICKING UP.

I want to revise Vat return 2014-15. How can I do that?

Our service request ticket number 0020163346 sent on 14.12.2018. The problem is UPLOAD IN PROGRESS. Same problem is facing from so many times. Please solve our problem. Our professional tax return filing is pending from April 2018 to December 2018. TIN Number is 27305236037.

We are also facing same issue for filling PT return. Challan payment is done but on PT site , it shows status pending while filling return.

Help Desk call centre staff is useless. They disconnect phone in between while filling return. No email id is proper and not getting reply.

We have filed 704 for the year of 2016-17 but till date no update in Sales Tax Sap Portal

I am searching for online profession tax (PTEC) payment portal but unable to find. I am really appreciate if you could help me out for online payment of Profession Tax (or) send me the online payment portal link.

Kindly tell me, How do I file Salary Professional Tax offline as facing some technical issue when processing it online.

New single revised return for 16-17, after uploading and submitting PDF file is not generated Form 233 & CST. Trying this procedure daily since one month but no positive result. Please help.

With reference to msg.Accura Process(vat no.27630079966V) Accura process year is April 2009 to September 2009 amount Rs.4024/- and year April-10 to September 10 amount 1713/- is already paid and submitted all challans and bank details to Thane office vat C-005 last 4-5 times. Then why same message is receiving again and again. We are now irritated to give same answer. Please take action finally in your record. You are in same track after 10 years.

I am unable to make the VAT payment from State bank of Hyderabad. Please help me.

Please help me to login to sale tax department portal for online MVAT payment. I have problem with login id and password.

I am unable to upload returns. May I know the reason?

I want to file The returns. I have certain doubts. Customer care numbers are not working. Please help me.

I HAVE TO FILE PT RETURN FOR MARCH-17. BUT NEW AUTOMATION IN DRAFT RETURN CHALLAN IS NOT SHOWING. HOW CAN I SOLVE THIS ISSUE?

I am not able to upload the quarter 3 return under Mahavat for the financial year 2016-2017. Please help me.

I am not able to upload the quarter 3 return under Mahavat for fy16-17. What can be done?

Our Tin number is 27771143203C. Our company name is wrongly entered. How can I solve this issue?

We have taken fresh registration but problem is effective dates for VAT and CAT are different. While uploading return it is showing error.

OUR PROBLEM IS WE ARE TRYING TO GET PROVISION ID AND PASSWORD FOR GSTN PORTAL. BUT WE OUR NAME IS NOT IN LIST OF GST PROVISIONAL ID PLEASE HELP.BABA ENTERPRISES TIN NUMBER IS 27580114865v.

We have taken following parties registration after 04.07.2016. We have uploaded the return monthly periodicity given registration date by department but when uploaded the return error is showing “The Dealer Periodicity is not correct”. Please guide and send us the solution. TIN Number is 27361211183 V,Best Fix Selenite Pvt.Ltd.

WHERE CAN I SHOW SALES AGAINST FORM H AND EXPORT SALES IN NEW AUTOMATION SALES ANNEXURES?

I have not received the c-form of QTR 2 of 2016-17. Its more than 15 days that I have applied for the same.

Toll free number is always busy. Where should I inform?

We have taken following parties registration after 25.05.2016. We have upload the return monthly periodicity given registration date by department but when upload the return error given “The Dealer Periodicity is not correct”. Please guide and send us the solution.

Dealer Name 1. Wadeshwar Packaging Tin No. 27581226970V

I have received Notice in Form 604 for F.Y. 2013-2014 and also seen CDA for 13-14 and I have paid my MVT Dues on 15.01.2016 Rs.288.00 ( 1st Quarter i.e. July-13 To Sept-13 Tax is Rs. 138+ Interest Rs. 69 ( 40 Days )till date ) and 2nd Quarter i.e. Oct-13 To Dec-13 Tax is Rs. 150.00 + Interest Rs. 70 ( 37 Days ) till date. I have Revised Return for Both the Quarters but e_annual Return is not uploading for the year 2013-2014 and Error shown is that ( Return annexure Error Report )

Sr.No. Line No. Box No. Error description

1 2 2 Revised Return is allowed for the Fin. year 2011-2012

So, therefore I can not reply for CDA Compliance of the year 2013-2014 online, and I have paid MVT both Quarter separately for 2nd Quarter and 3rd Quarter.

I need to know whether electroplating work is liable to VAT. If yes then what is the vat rate?

NOW A DAYS FUNCTIONALITY OF GETTING PROVISIONAL ID IS AVAILABLE. KINDLY LET ME KNOW HOW I CAN GET PROVISIONAL ID, AS I HAD LOG IN, WITH VAT TIN ID AND PASSWORD. AFTER THAT I GOT NEW PAGE SHOWING GST PROVISIONAL ID LOGIN. I HAD GONE THERE, BUT I COULD NOT GET FLASH MESSAGE FOR REGISTERING THE SAME. KINDLY LET ME KNOW, I SHALL BE HIGHLY OBLIGED FOR THAT.

From :

SOMLING TEXTILES

TIN NO.-27310396653V

PAN NO.-ACUPN4749H

SIR,

OUR PROBLEM IS WE ARE TRYING TO GET PROVISION ID & PASSWORD FOR GSTN PORTAL. BUT WE DON’T KNOW WHAT IS THE PROBLEM CREATED. WE CLICK GSTN ENROLLMENT PROVISIONAL ID, WINDOW WILL OPEN BUT POPUP WILL APPEAR ASKING “YES” WINDOW CAN’T BE SHOWN. PLEASE SEND US SOLUTION FOR YOUR EARLIER.

HOW CAN I KNOW MY LIABILITY FOR F.Y.13-14 AS PER CDAR?

Login using your tin no and password on mahavat.gov.in. Click on e-services, then go to CDA information, select FY and then download your CDA Details. You will know your liability, if any, for FY 2013-14.

File error: The Dealer periodicity is not correct. Please check

Please mention effective date of registration to end of quarter/ month in return periodicity.

Please inform the extended date if any of filing quarterly return for the period from 1.7.2016 to 30.9 2016.

WE HAD UPLOAD OUR MONTHLY RETURN FOR THE PERIOD OF JUNE,JULY, AUG AND OCT-16 BUT TILL DATE WE HAVE NOT RECEIVED FROM FROM VAT SITE.

OUR TIN NO IS 27070364484.

UNILEX COLORS AND CHEMICALS LTD.

What is the expected date of submission for returning?

Today is the Last date of Quarterly Return Filing of MVAT April to June but still I am not able to download the electronic New Form of MVAT. Please Guide me to do that.

We applied CST Application on dated 08-NOV-2016.

Transaction id : ST-REQ-081116-2651569

Transaction date : 08/11/2016

Allotted Desk ID : MUM-VAT-E-705

CST TIN no : 27230063017

Name of Dealer : SIDDHI SALES CORPORATION

But till date 08/11/2016 it is not processed. Can We know the reason?

I am unable to upload 2nd quarter of MVAT return. My vat tin no is 27460878515.

PLEASE UPDATE MAHAVAT SITE FOR DUE DATES FOR Q1 & Q2 RETURNS. WHEN Q2 WILL BE ENABLED TO UPLOAD? PLEASE MENTION IT SO THAT DEALERS CAN DO BEFORE DUE DATE DEADLINE.

TIN NO : 27181209827

IT IS SHOWING AS INVALID. PLEASE CHECK AND INFORM.

I have applied for New user on MSTD portal but I have not received my user Id and password.

Please reply.

How can I check new dealer vat return periodicity?

New dealer vat return periodicity from 2016-17 onwards is on monthly basis.

How will I know the name of loader officer of dealer?

Can I get a Certificate of Tax Consultant? I have completed My B.com in 2005 and working in CA firm from 2005 on wards.

For MVAT Registration, near about 3 months I am getting the same message (Nature of Work/Business/Activity can not be blank) and application is not submitting.

This is to inform you that we have downloaded the monthly VAT return form, filled, validated and the file got generated.

When we uploaded the file it is showing error as “PLEASE ENTER THE CORRECT TIN IN THE FILE HEADER”. Kindly help us to upload the file.

How can I get tin number for my retail business in Mumbai?

WE HAVE APPLIED FOR SALES TAX REGISTRATION, BUT WHILE APPLYING WE ONLY APPLIED FOR VAT ON 07/10/2016.

WE WANT TO APPLY FOR CST & PTEC ALSO. BUT FORM IS NOT GETTING OPENED. PLEASE HELP US FOR APPLYING CST & PTEC.

DEAR BRO OPEN MSTD WEBSITE IF YOU ARE ALREADY REGISTERED MSTD THEN, CLICK EXISTING USER LOGIN MSTD THEN, SELECT NEW REGISTRATION AND SELECT CST AND PTEC.

Please read user manual for registration to apply for single Act like CST or Pt when you are already registered under one of the act i.e.VAT

How can I upload signature in “Upload document” for VAT registration?

You scan and upload just like other documents.

NEW SYSTEM APRIL 16 SALES AND PURCHASE ANNEXURE UPLOAD ON 22.09.16. BUT DRAFT RETURN YET NOT RECEIVED BY MAIL AND NOT SEEN IN HISTORIC RETURN.

I have applied for PTEC, 5 days ago. It shows my status form submitted but I do not received tan no yet.

What is the rate of taxes of today?

I am filing vat return for the month April 2016. Error is showing in purchase that Tax amount is greater than tax rate. My purchase value – less goods return = amount Rs. __ tally column no 9 x also.

Please guide me for validate return

What is the processor & how much cost for applying Vat No?

We have applied for Voluntary VAT registration 0n 22nd Aug and got mail stating that our application got rejected for some documents on 25th. We have resubmitted the documents on 26th Aug 2016 (attached the required documents) in the mail message and sent. There is no reply on the issue so far. Is it enough if we send it through the mail message or do we have to go to VAT office personally with original copies of documents?

WE MADE CST PAYMENT MANUAL INSTEAD OF E-PAYMENT SO IN CASE,SALES TAX DEPARTMENT REQUIRED CIN NO FOR E PAYMENT.

SO PLEASE GUIDE US WHAT TO DO?

REGARDS,

MANISUDAN DESHPANDE

JALGAON MAHARASHTRA

I WAS A REGISTERED DEALER UNDER MVAT, CST,PTEC. BUT BECAUSE OF TRANSFER OF BUSINESS I CANCELED ALL MY REGISTRATION. I HAVE RECEIVED SUCH ORDERS AND OUR WEBSITE MAHAVAT SHOWS MY STATUS AS CANCELLED.

NOW I WANT TO APPLY FOR REGISTRATION IN RESPECT TO MY NEW FIRM. BUT WHEN I TYPE MY PAN FOR REGISTRATION THE MESSAGE RECEIVED AS THIS PAN TIN HAS BEEN GENERATED FOR THIS PAN.

THEN HOW TO UNLOCK MY PAN TO REUSE OUR E-FACILITY FOR REGISTRATION.

It seems VAT department is on permanent sick leave, no email goes, No one picks up phone and help desk is as good as non existent, today is 13th July and returns for the quarter are still not uploading.

Message comes when uploading : Returns of the financial year 2016-17 not allowed. If the site has problems at least email we should be able to contact. It is returning as e mail box full.

MY VAT/TIN APPLICATION GOT REJECTED DUE TO SOME DOCUMENTATION WHEN APPLIED LAST YEAR IN SEPTEMBER. ON APPLYING FRESH AS PER NEW ONLINE SYSTEM IT IS SHOWING ERROR “TIN NO ALREADY REGISTERED FOR THIS PAN” SO I AM NOT ABLE TO PROCEED FURTHER.

DOES ANYONE KNOW FACING/FACED SAME ISSUE? IF YES HOW TO RESOLVE.

SALES TAX PEOPLE SAYING THAT ITS AN IT GLITCH WHICH WILL RESOLVE AUTOMATICALLY WHICH I AM HEARING FROM LAST 3 MONTHS NOW.

ANYONE HAVING A BRIGHT SUGGESTIONS? PLEASE POST. I AM GREATLY HARASSED BY THE NON COOPERATING PEOPLE AT THIS SUCH IMPORTANT DEPT.

My PTEC is 99160804451P. Last 5 years I am paying PT on the same TIN but while paying the current PT I found that my PT was registered with another party namely synome coop chemicals. Kindly check the mistake as early as possible.

Can anyone tell me what was the rate of VAT in the year 2008?

I applied for vat tin on 7/4/2016 still I could not upload document because of our slow server. So please tell me any option for document submission.

We are a partnership firm of two. Its a small heart Center. What are the registrations we are required to take under the prevailing Taxes in Maharashtra. We are having PAN No., Registrar of Firms, Shop & Establishment Act registered. I heard that we should also go for TAN No. So please advise which other Nos. we should apply for. We reverse the heart disease. Kindly advise.

Our company name is Sawti Agro Tech we applied on 29/05/2016. How much time it will require to get CST and VAT number?

Can you send me a link on how to check the status of TIN NO? I have already made application for new registration and want to know the status of TIN NO.

NEW MVAT E-REGISTRATION SYSTEM IS NOT WORKING PROPERLY. WHAT SHOULD I DO?

How can I get the C-form Serial nO.27051617707832 of Sialkot Shop?

I want to know latest update on PT rules.

I have applied for vat and tin registration On 29-5-2016. How much time will be required?

We applied CST Application OF 4TH QTR of F.Y.15-16 on dated 13-MAY-2016

Name of Dealer : B. A. ENTERPRISES

CST TIN 27380118661

When we uploaded the form there is a one error showing as duplicate form uploaded by dealer but in 1st three Qtr there is no duplicate bill. What we can do?

HOW TO VALIDATE SIGNATURE IN FORM -C?

First update your PDF version then Check it will validate the signature.

What is the periodicity for VAT return of Non audit firm ?

Is Purchase & Sales register compulsory for composition firm ?

Is purchase & sales register compulsory for Set Off firm ? Whether I can write manually or it in computer ?

We applied CST Application on dated 24-Feb-2016.

Transaction id : ST-REQ-240216-2070742 & ST-REQ-240216-2070727.

Transaction date : 24/02/2016

Allotted Desk ID : PAL-VAT-E-005

CST TIN no : 27590299790

Name of Dealer : NAYAKEM ORGANICS PVT LTD

But till date 29/04/2016 it is not processed? Can We know the reason?

I want to start a business. How to obtain sale tax number? Is it mandatory to have a permanent residence? I have both residence and shop on rent. What should I do?

I applied CST Application on dated 02/03/2016.

Transaction id : ST-REQ-020316-2092757

Transaction date : 02/03/2016

Alloted Desk ID : None

CST TIN no : 27460782097

Name of Dealer : Q TEX

But still as on dated 17/03/2016 it is not processed? Can I know the reason?

Please log in check for defect memo.

If there are any outstanding dues or returns not filed it will appear there. If there are no CST sale transactions & therefore you have not filed CST return, it will show in missing returns. You reply to defect memo to settle the issue.

Always see that you apply for C form after gap of 24 hours of filing vat / cst returns. You can also reapply for C form.

S.S.Trading co Nagpur.vat tin no 27050951830v/c

I want to know what was the rule for voluntary registration in year 2013-14 for disposal of deposit of Rs 25000. I understand this amount could be adjusted against payment of taxes, interest,penalties etc during the year of deposit or in second year. Please reply.

Sir, I am unable to complete the filling of C Form which I want to issue to my supplier in Gujarat for the financial year- 01st April,2011 To 31st March,2012. Even after filling all the information in downloaded C form, under SOR, I am unable to validate the same. My company’s name is Rank Enterprises, Mumbai-400 016. And my VAT TIN NO.27430230426. Please help.

How can I register my e-payment?

Register in the below link.

https://www.mahagst.gov.in/en

HOW TO VALIDATE SIGNATURE OF THE CONCERN OFFICE IN C-FORM?

How to make VRS Payment? My Bank is SBI.

I HAVE LOST MY VAT & CST TIN CERTIFICATE. CAN YOU GUIDE HOW COULD I GET IT FROM WHERE & WHAT IS THE PROCEDURE? I ALSO WANT TELEPHONE NUMBER OF THE DEPT.

I have applied for P.T.E.C. My application number is 000003700674, dated 29/08/2018 but I have not received P.T.E.C. certificate. Please do needful.