Ageas Federal Life Insurance Mumbai Customer Toll Free Helpline Number : ageasfederal.com

Organisation : Ageas Federal Life Insurance Co Ltd

Facility Name : Customer Toll Free Helpline Number

Head Quarters : Mumbai

Industry : Insurance

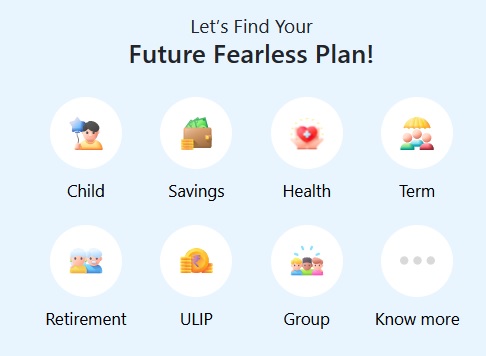

Service / Product : Life Insurance, Health Insurance

Website : https://www.ageasfederal.com/contact-us

| Want to comment on this post? Go to bottom of this page. |

|---|

Ageas Federal Life Insurance Toll Free Helpline Number

Reach out and give us a call – 1800 209 0502 (Toll Free)

Write us your questions – support[AT]ageasfederal.com

Find our office at :

Ageas Federal Life Insurance Co Ltd

22nd Floor, A Wing, Marathon Futurex,

N. M. Joshi Marg, Lower Parel (East),

Mumbai 400013, India

Related / Similar Customer Care : Pramerica Life Insurance Gurugram Customer Service Number, Branch Address

Ageas Federal Life Insurance Complaint Resolution

In case you have a complaint, the company shall send a written acknowledgement to you within 3 working days of the receipt of the grievance. The company shall resolve the grievance within 2 weeks of its receipt and send a final letter of resolution

Step 1 : If our response doesn’t meet your expectations you can write to:

Ms Reema Bhasker

Assistant Vice President – Customer and Sales Support

Ms Elizabeth Taylor

Chief Manager – IGMS & Complaints

Ageas Federal Life Insurance Co Ltd

22nd Floor, A Wing, Marathon Futurex, N. M. Joshi Marg, Lower Parel (East), Mumbai 400013, India

Email : Reema.bhasker[AT]ageasfederal.com & Elizabeth.taylor[AT]ageasfederal.com

Step 2 : If you are still not satisfied with the response from Chief Manager – Customer and Sales Support or Chief Manager – IGMS and Complaints you may write to :

Mr Rajesh Ajgaonkar

Grievance Redressal Officer

(* Also designated as Nodal Officer as per the Consumer Protection (Direct Selling) Rules, 2021)

Ageas Federal Life Insurance Co Ltd

22nd Floor, A Wing, Marathon Futurex, N. M. Joshi Marg, Lower Parel (East), Mumbai 400013, India

Email : grievance[AT]ageasfederal.com

Head Office Number : 022 – 2302 9200

Helpline Number : 1800 209 0502 (Toll Free)

Ageas Federal Life Insurance Grievance Redressal Policy

Procedure to Register the Complaint :

** The Company has implemented a Customer Relationship/Service Management System enabling automated management of Grievances / Complaints, it is also integrated with the Integrated Grievance Management System (IGMS) of IRDAI that enables registration of grievances, tracking the resolution, generating MIS and periodic reporting to the Authority.

** Grievances received through various channels, touch points of the company will be registered and integrated with the system to provide a uniform resolution and experience to the customer.

Complaint Resolution Process :

1. The Company will send a written acknowledgement to the customer within 3 working days of the receipt of the grievance.

2. The acknowledgement shall contain the name and designation of the officer who will deal with the grievance.

3. If the complaint is resolved within 3 days, the final communication will also act as the acknowledgment of the complaint.

4. The Company shall resolve all grievance within 15days of its receipt and send a final letter of resolution.

5. The Company will send the complainant a written response which offers to redress or reject the complaint and gives reasons for doing so; the Company shall inform the complainant about how he or she may pursue the complaint, if dissatisfied.

6. The Company will also inform that it will regard the complaint as closed, if it does not receive a reply within 8 weeks from the date of receipt of response by the Complainant.

Escalation :

The following is the escalation matrix in case there is no response to a grievance within the prescribed timelines or if the customer is unsatisfied with the Company’s efforts to resolve the grievance.

1st level of escalation: Manager- Customer Relations (support[AT]ageasfederal.com)

2nd level of escalation: Chief Operating Officer (grievance[AT]ageasfederal.com)

Complaint re-opening process :

** In case the customer is not satisfied with the resolution provided by the Company, the customer can approach any of the touch points mentioned in the policy within 8 weeks of the receipt of the communication failing which, the Company will consider the complaint to be satisfactorily closed.

** In the event of customer coming back within eight weeks, the original ‘grievance’ interaction will be reopened for review of the earlier decision. Post reviewing all the facts, suitable resolution will be provided to thecustomer as per Grievance redressal policy.

** The complaint can also be reopened in instances where requirements which were called from the customer have been received. Alternatively, the grievance may be reopened if the customer provides fresh evidence / additional requirements to support his stand.

Grievance Redressal Officer (GRO)

The Company has designated Chief Compliance officer of the Company as the Grievance Redressal Officer, the address & contact details of the GRO are as below

Grievance Redressal Officer,

Ageas Federal Life Insurance Co Ltd,

22nd Floor, A Wing, Marathon Futurex,

N. M. Joshi Marg, Lower Parel (East),

Mumbai 400013, India.

Email: Grievance[AT]ageasfederal.com

Helpline Number: 1800 209 0502 (Toll Free)

Head Office Number: 022 – 2302 9200

The Branch Manager/Head of the Agency branches are the officer nominated for that Branch Office to receive the complaint /s on behalf of the Company.